will salt deduction be eliminated

Posted on November 9 2017 Updated on November 10 2017. It should be eliminated not expanded.

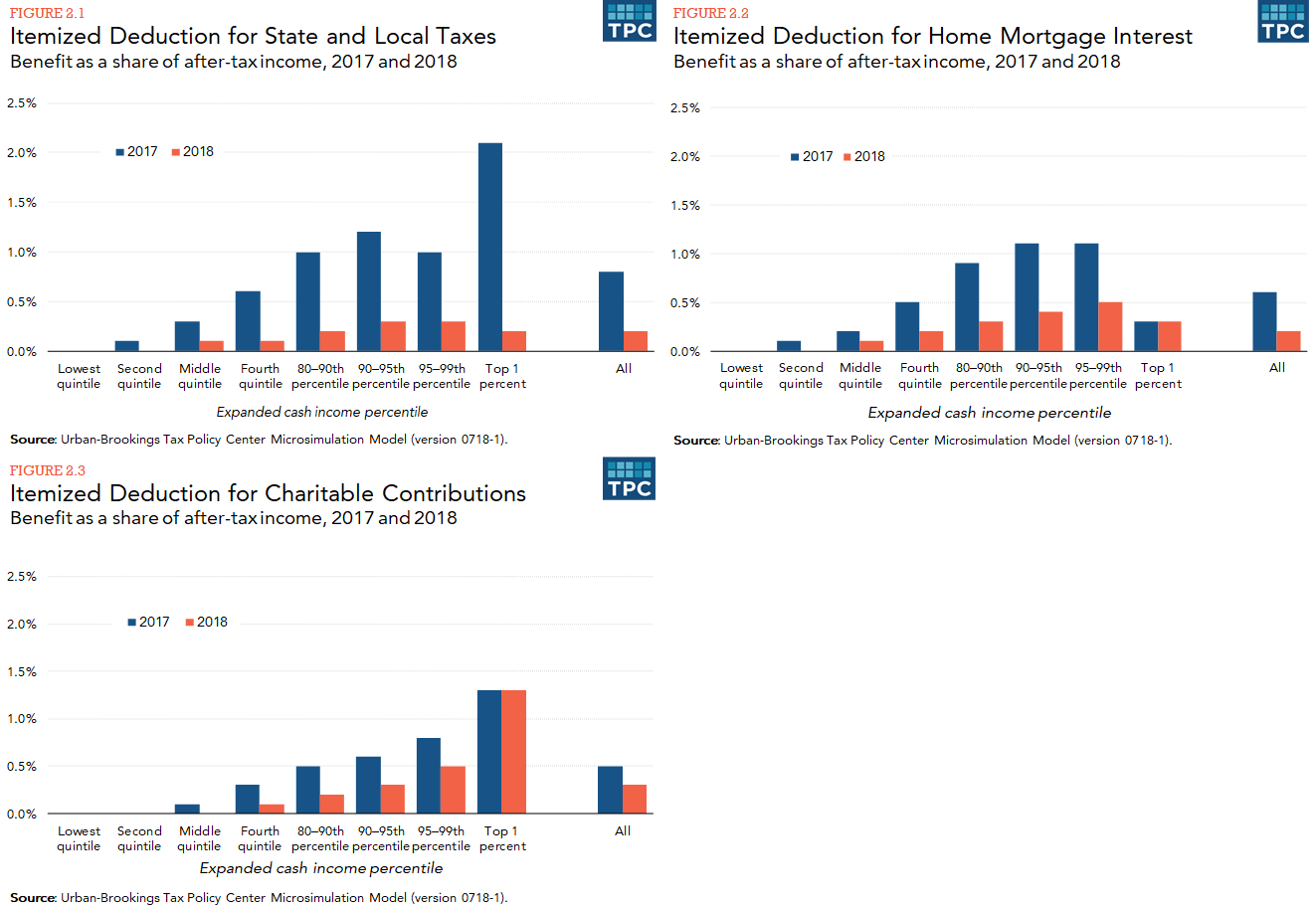

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Nita Lowey D-NY and Rep.

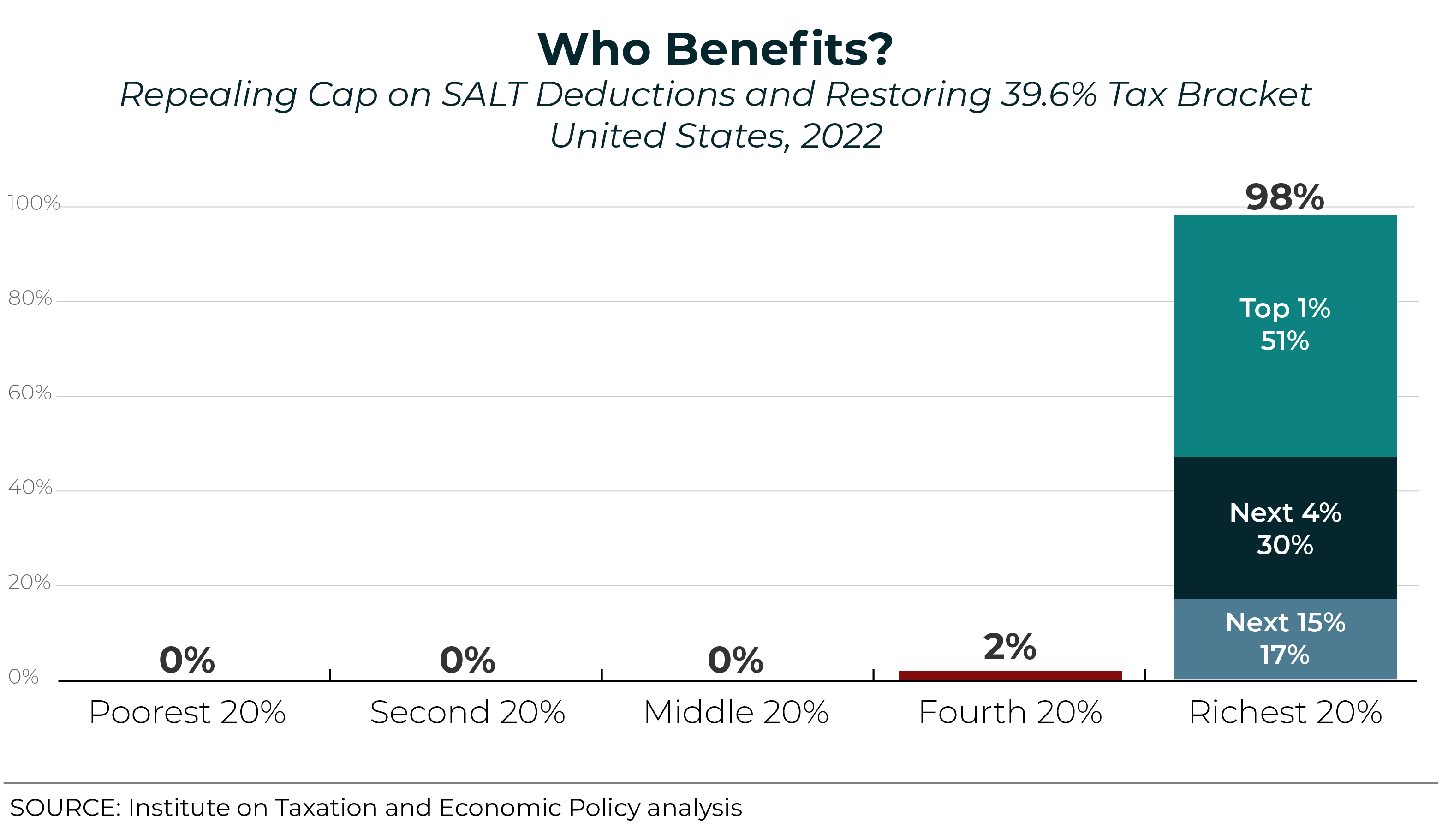

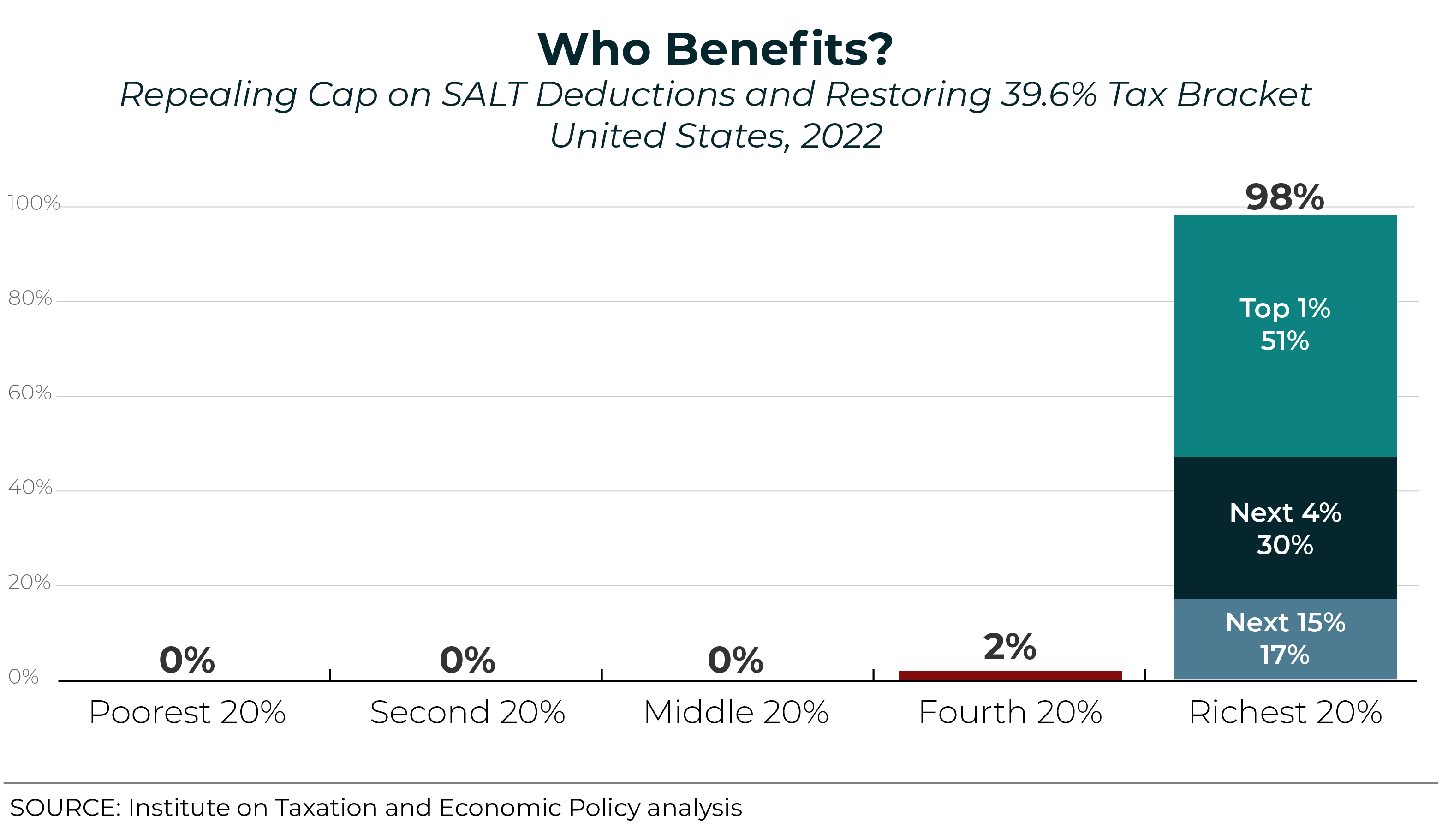

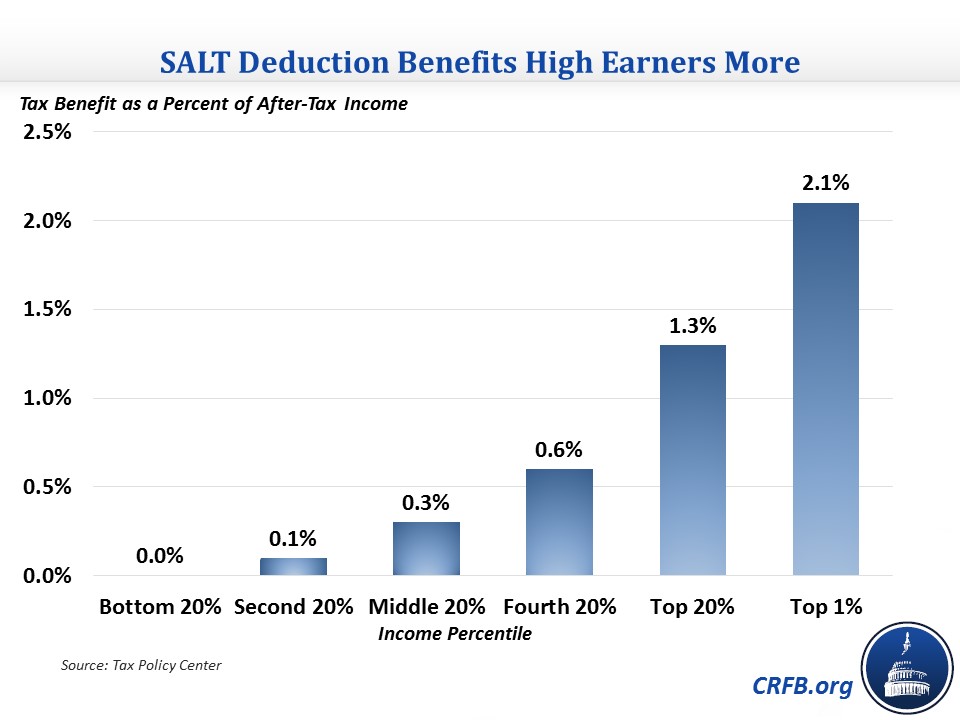

. Republicans included the cap in order to raise revenue that could be used to offset the cost of tax cuts elsewhere in the. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country.

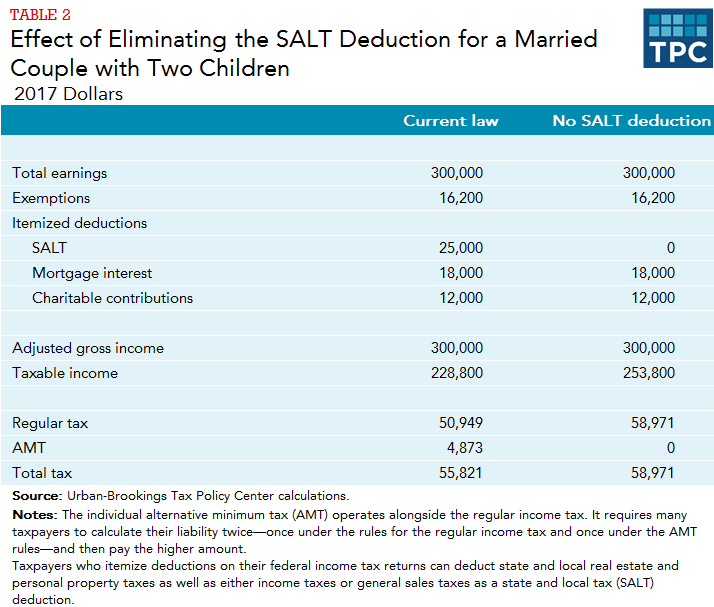

Many economists believe that a complete repeal of the cap on the SALT deduction would be costly to the federal government. If Congress eliminates SALT middle class homeowners will see their taxes increase. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

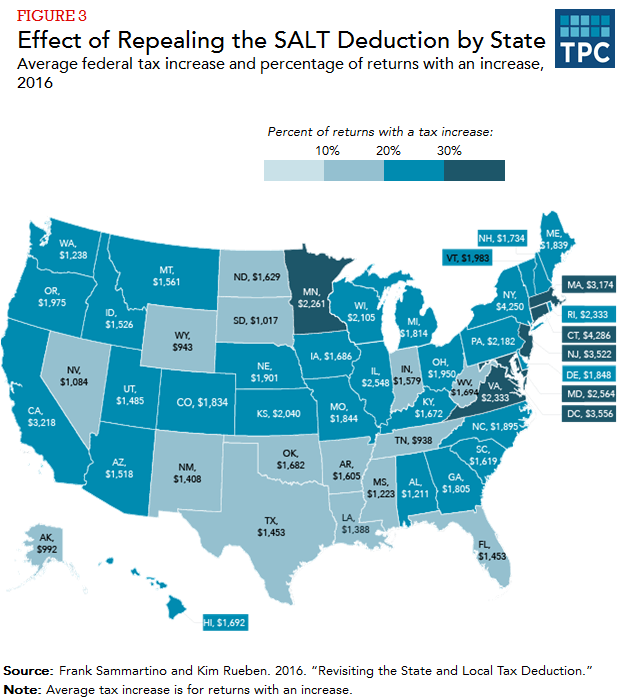

Taxpayers cant get out of them. The delegations promoting the reinstitution of SALT. More facts States and localities generally raise about 23 trillion in taxes each year.

The SALT tax deduction is a handout to the rich. The IRS just issued Regulations preventing donations to. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. For advocates of the deduction eliminating it. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

For tax years 2020 and 2021 the 10000 limitation would be eliminated entirely for all taxpayers. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. The topic goes beyond simple politics.

When it comes to the SALT deduction cap and delaying the age of required distributions from retirement accounts. In 2018 Democratic presidential nominee Joe Biden and his wife took a 10000 deduction. State and local tax deductions were restricted or eliminated by the 2017 Tax Act.

The Facts on the SALT Deduction. No the SALT deduction does not benefit only the wealthy. The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones.

Defenders of the SALT deduction such as the National Governors Association point out that state and local income real estate and sales taxes are mandatory. President Trumps 2017 tax-cut law capped the SALT deduction at 10000. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the wealthy.

The federal tax reform law passed on Dec. For the 2019 tax year the marriage penalty associated with the 10000 limitation on state and local tax deductions which limits married couples filing jointly to 10000 of SALT deductions would be eliminated. Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country.

The delegations promoting the reinstitution of SALT. The House Republican tax plan would eliminate a federal tax deduction for. Theres reason to believe the SALT deduction limit could disappear if Biden wins the presidential election.

However many filers dont know how the. The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones. New limits for SALT tax write off.

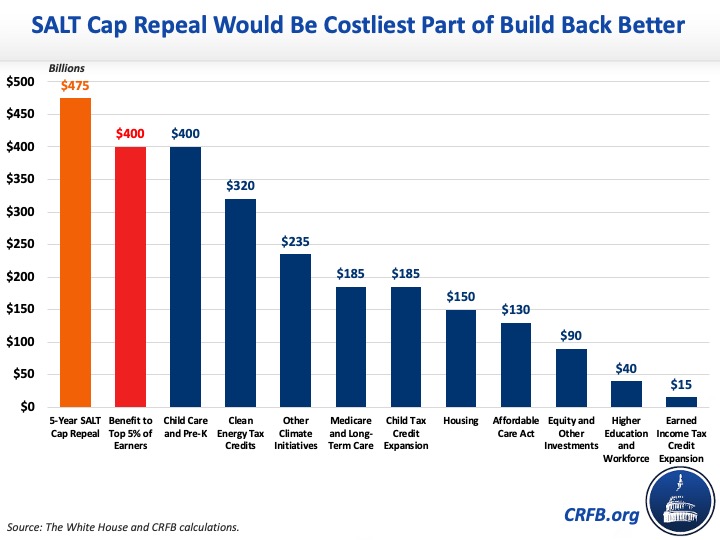

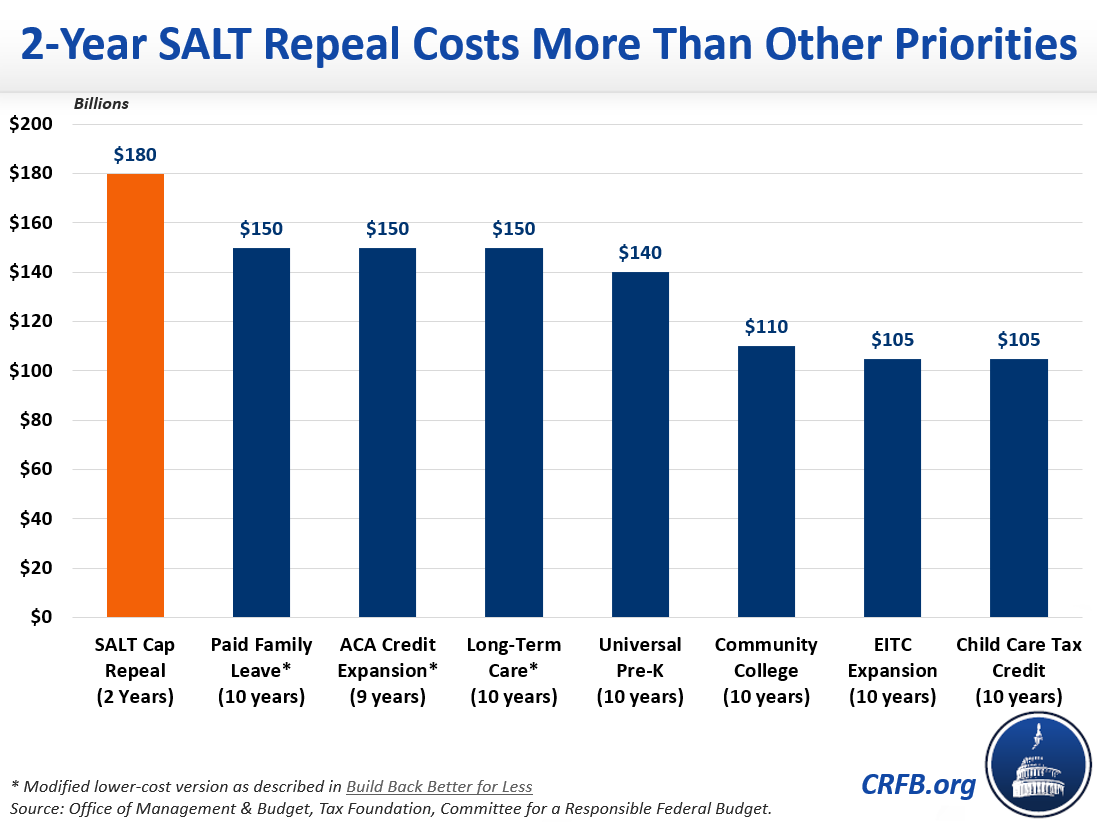

A recent July 2021 estimate by the Tax Foundation put the loss to the Federal government at 380 billion. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. A recent July 2021 estimate by the Tax Foundation put the loss to the Federal government at 380 billion.

The BBBA would raise the SALT deduction limitation from 10000 per year to 80000 per year from 2021 through 2030 lower it to 10000 in 2031 and then eliminate it. It makes sense to raise it. Homeowners that make between 50000 and 200000 would see an average tax increase of 815 even if the standard deduction is doubled.

The BBBA would raise the SALT deduction limitation from 10000 per year to 80000 per year from 2021 through 2030 lower it to 10000 in 2031 and then eliminate it. REF Most tax preferences in.

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Opinion The Debate Over A Tax Deduction The New York Times

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget