dallas county texas sales tax rate

The minimum combined 2022 sales tax rate for Dallas Texas is. 214 653-7811 Fax.

Texas Sales Tax Rate Changes January 2019

As for zip codes there are around 138 of them.

. The average cumulative sales tax rate between all of them is 825. As of the 2010 census the population was 2368139. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dallas County.

This is the total of state and county sales tax rates. To make matters worse rates in most major cities reach this limit. City or County Rates.

The Texas state sales tax rate is currently 625. Help us make this site better by reporting errors. How much are taxes in Dallas TX.

214 653-7888 Se Habla Español. Dallas County TX Sales Tax Rate. 05 is a.

As of the 2010 census the population was 2368139. The total sales tax rate in any given location can be broken down into state county city and special district rates. The current sales tax rate in Coppell is 825.

Always consult your local government tax offices for the latest official city county and state tax rates. This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction.

The sales tax rate does not vary. Branch ISD 972-968-6171. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2.

A full list of these can be found below. The County sales tax rate is. Dallas is located within Dallas County TexasWithin Dallas there are around 80 zip codes with the most populous zip code being 75217The sales tax rate does not vary based on zip code.

If you need access to a database of all Texas local sales tax rates visit the sales tax data page. This is the total of state county and city sales tax rates. Ad Lookup TX Sales Tax Rates By Zip.

This rate includes any state county city and local sales taxes. DC College District. 1 for City operations.

Code Taxing Entity Number Hmstd 3 Hmstd or older 4 Person 4 Tax Rate Tax Rate AS Carrollton-Farmers. The latest sales tax rate for Dallas County TX. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

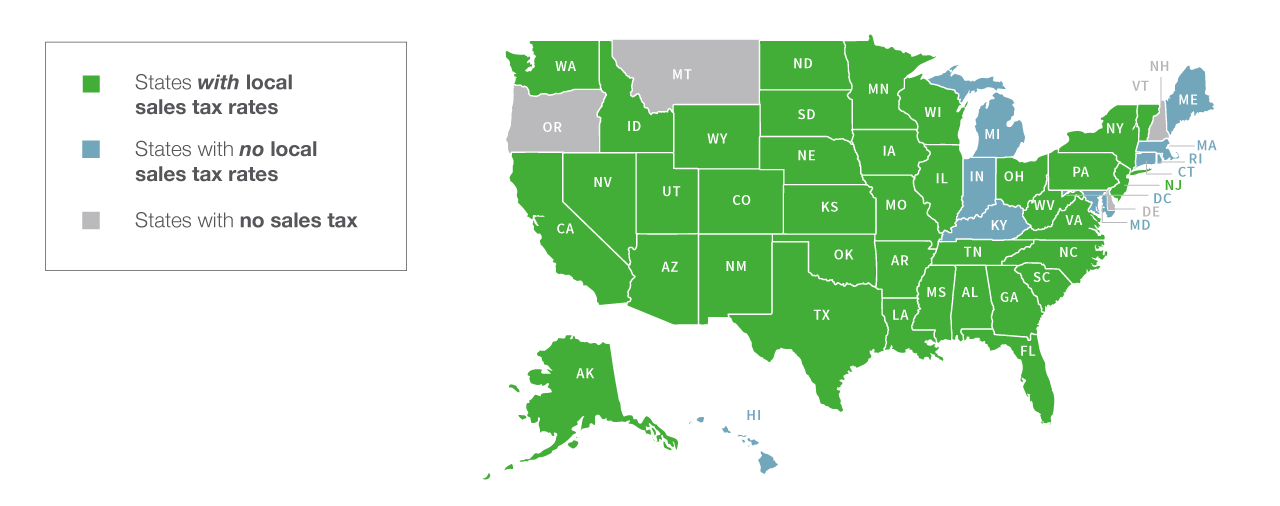

2020 rates included for use while preparing your income tax deduction. Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit our Texas sales tax calculator to lookup local rates by zip code. TEXAS SALES AND USE TAX RATES July 2022.

You can print a 825 sales tax table here. Dallas County is located in Texas and contains around 21 cities towns and other locations. The average cumulative sales tax rate in Dallas Texas is 825.

There is no applicable county tax. View the Notice of 2021 Tax Rates PDF. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825.

This includes the rates on the state county city and special levels. Free Unlimited Searches Try Now. The Dallas sales tax rate is.

The current total local sales tax rate in Dallas County TX is 6250. BalchSprings Dallas Co 2057119 020000 082500 BayouVista Galveston Co 2084205 017500 080000 BalconesHeights Bexar Co 2015030 010000 082500 BaysideRefugio Co 2196031 010000 072500. Dallas County is a county located in the US.

For tax rates in other cities see Texas sales taxes by city and county. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. It is the second-most populous county in Texas and the ninth-most populous in the United States.

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables. The 2018 United States Supreme Court decision in South Dakota v.

Name Local Code Local Rate Total Rate. Tax rate and budget information as required by Tax Code 2618 PDF. Wayfair Inc affect Texas.

What is the sales tax rate in Dallas County. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for.

Did South Dakota v. Dallas TX 75202 Telephone. The most populous location in Dallas County Texas is Dallas.

Tax Office Past Tax Rates. ES Cedar Hill ISD ¹. 60 Day Burn Ban in Effect as of June 23 2022.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. The City retains 2 and is used as follows. The Texas Legislature passed House Bill 855 which requires state agencies to publish a list of the three.

The minimum combined 2022 sales tax rate for Dallas County Texas is. The December 2020 total local sales tax rate was. This rate includes any state county city and local sales taxes.

City or County Rates. The 2021-2022 tax rates are calculated by Dallas County PDF in accordance with Texas Tax Code. The Texas state sales tax rate is currently.

The latest sales tax rate for Dallas TX. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes.

The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. Dallas County is a county located in the US. The Dallas County sales tax rate is.

The combined sales tax rate for Dallas County TX is 725. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas. The Texas sales tax rate is currently.

The world-famous city of Dallas is situated within multiple.

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To File And Pay Sales Tax In Texas Taxvalet

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

How To File And Pay Sales Tax In Texas Taxvalet

How To Charge Your Customers The Correct Sales Tax Rates

How To File And Pay Sales Tax In Texas Taxvalet

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sales Tax Rates By City County 2022

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Texas Sales Tax Guide For Businesses