san antonio local sales tax rate 2019

The December 2020 total local sales tax rate was also 8250. The Fiscal Year FY 2023 MO tax rate is 33011 cents.

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250.

. The total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent. Published on June 25 2019 by. The Texas sales tax rate is currently.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction. Wayfair Inc affect Texas. The san antonio sales tax rate is.

No state rates have changed since July 2018 when Louisianas declined from 50 to 445 percent. The December 2020 total local sales tax rate was also 7750. Some cities and local governments in Bexar County collect additional local sales taxes which can be as high as.

The current total local sales tax rate in San Antonio TX is 8250. An alternative sales tax rate of 6375 applies in the tax region Socorro which appertains to zip code 87832. The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local sales taxesthe local.

Texas Comptroller of Public Accounts. There are approximately 589 people living in the San Antonio area. City sales and use tax codes and rates.

1000 City of San Antonio. This would put texas businesses at a competitive disadvantage discouraging shoppers from neighboring states who currently travel. The portion of the sales tax rate collected by San Antonio is 125 percent.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and Alabama 914 percent. 127 rows Sixteen cities with populations of 200000 or more do not impose local sales taxes though some have state sales taxes as high as 7 percent Fort Wayne and.

The San Antonio sales tax rate is. The San Antonio New Mexico sales tax rate of 65 applies in the zip code 87832. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent.

Published on September 20 2019 by Youngers Creek. San Antonio collects the maximum legal local sales tax The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The San Antonio Texas general sales tax rate is 625.

The County sales tax rate is. Lower sales tax than 87 of Florida localities 05 lower than the maximum sales tax in FL The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County. Local Code Local Rate Total Rate.

Jurors parking at the garage. San Antonio Local Sales Tax Rate. Maintenance Operations MO and Debt Service.

The current total local sales tax rate in San Antonio TX is 8250. We would like to show. The property tax rate for the City of San Antonio consists of two components.

Every 2019 combined rates mentioned. Rates will vary and will be posted upon arrival. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Did South Dakota v. The 2018 United States Supreme Court. San Antonio Local Sales Tax Rate 2019.

Up And Up Sales Taxes Across The State Show Me Institute

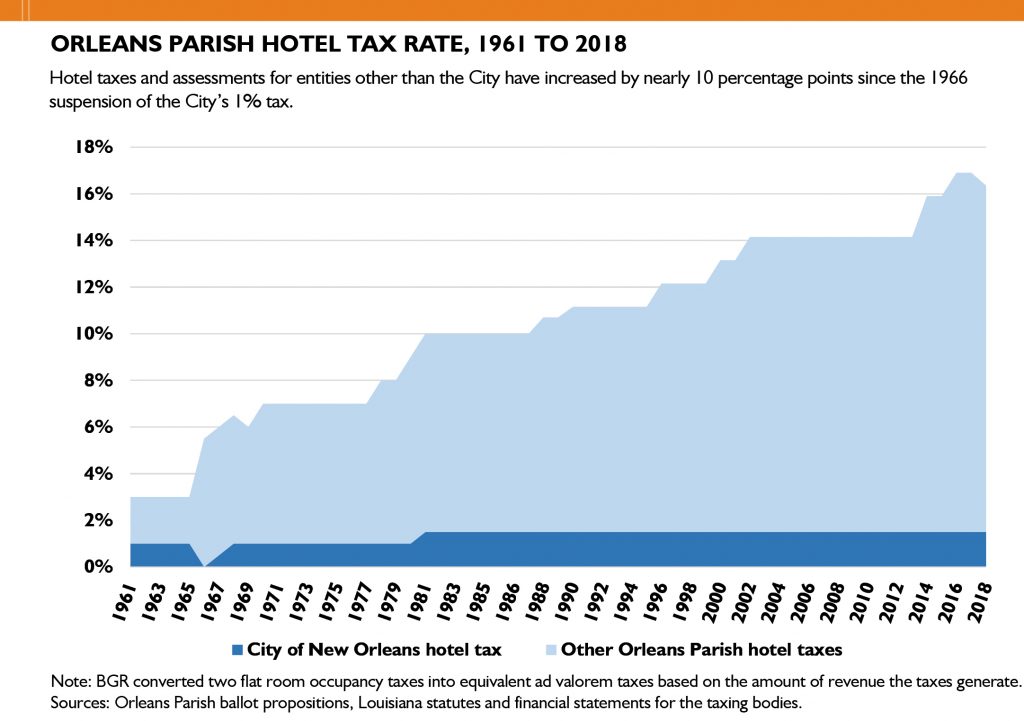

Bgr Analyzes The Orleans Parish Hotel Tax Structure

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Salon Com

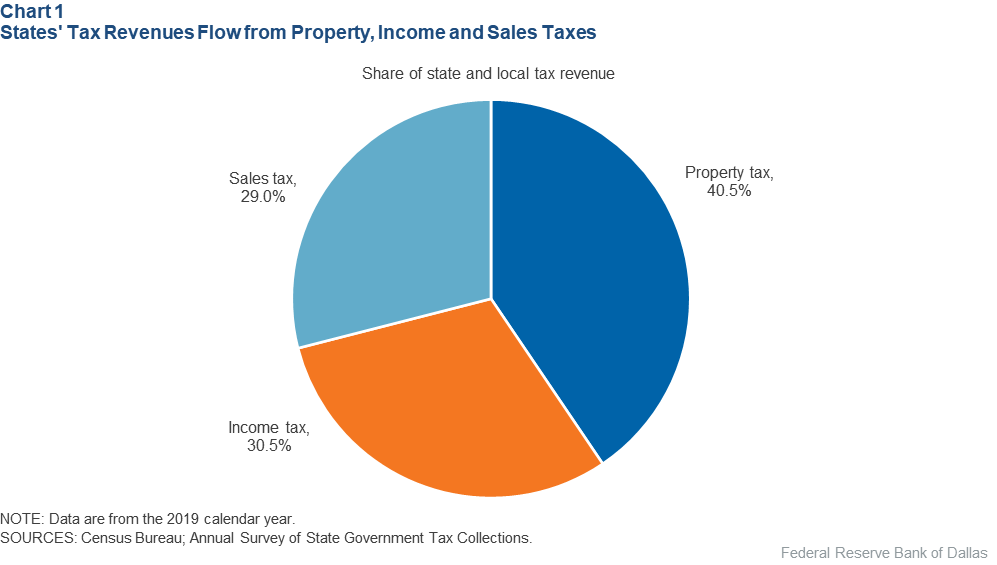

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

Tac School Finance The Elephant In The Property Tax Equation

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

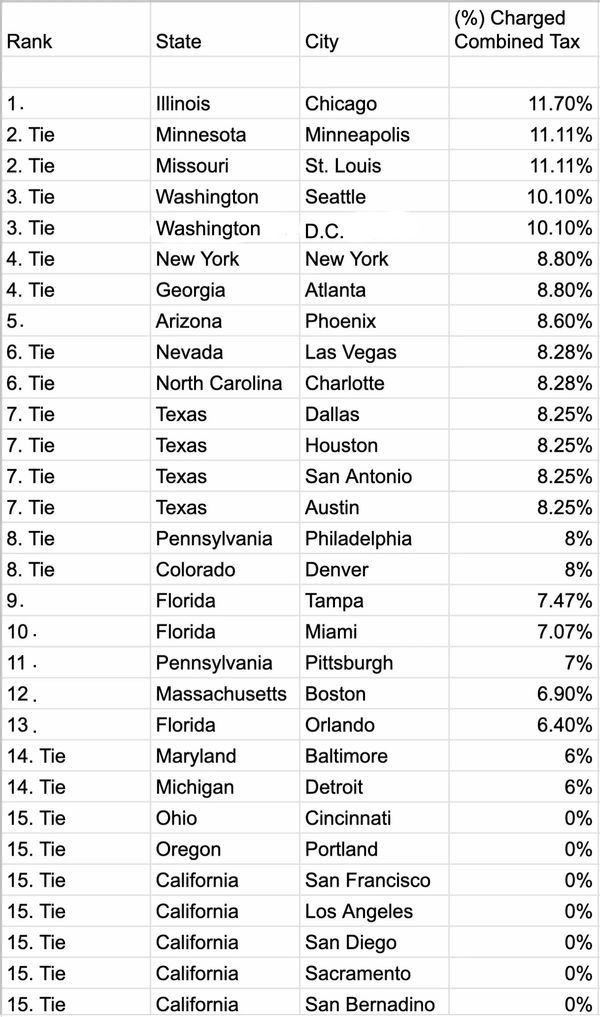

Sales Tax Rates In Major Cities Tax Data Tax Foundation

/https://static.texastribune.org/media/files/2c80fe77f6e2a3c06be6bd8c4a7baeeb/06%20Glenn%20Hegar%20Biennial%20Revenue%20Estimate%20MG%20TT.jpg)

Texas Property Tax Cuts School Funding Raise Sustainability Questions The Texas Tribune

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Publication 600 2006 State And Local General Sales Taxes Internal Revenue Service

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption