utah tax commission payment

7703 The Utah State Tax Commission accepts Visa. You are being redirected to the TAP home page.

24 Utah Sales Tax Token 1 Utah State Tax Commission Ebay

You can also pay online and.

. From the main TAP page Payments box choose Make an e-Check payment or Make a credit card payment. Property Tax Division Phone Fax and Email Contacts. A payment agreement plan cannot be set up until after the return due date and when weve processed your return.

Complete each screen and click Next. Mail your payment coupon and Utah return to. This fee is collected by a financial intermediary that processes the credit card transaction and.

Are Travel IBA 6th digit 1 2 3 4 transactions sales tax exempt. Make your check or money order payable to the Utah State Tax Commission. If you cannot pay the full amount you owe you can request a payment.

Payments by credit card may be made either online at taputahgov or over the phone by calling 801-297-7703 800-662-4335 ext. Taxutahgovforms for information on how to calculate the interest. Your session has expired.

Please visit this page to. Individual income and fiduciary taxes Instructions. This calculator will calculate the penalty and interest you owe for late filing and late payment of Utah income or.

UTAH STATE TAX COMMISSION Property Tax Bills and Payments Questions about your property tax bill and payments are handled by your local county officials. File electronically using Taxpayer Access Point at. This section discusses information regarding paying your Utah income taxes.

This section will help you understand tax billings and various payment options. Or by the 15th day of the fourth month after the fiscal year ends. Javascript must be enabled to use this site.

Skip to Main Content. Utahs Taxpayer Access Point. Utah State Tax Commission.

No portion of the convenience fee is paid to Utah County or to any other Government entity. Where to File Mail or deliver the coupon below with your payment to. The Division of Finance processes tax refunds sent from the Utah Tax Commission.

You must file your return and pay any tax due. See Taxpayer Access Point TAP for electronic payment options including. These are then matched against debts owed to state agencies institutions courts and the IRS.

By April 18 2022 if you file on a calendar year basis tax year ends Dec. Only click the Submit button when you have. With health and social distancing protocols in place taxpayers would have to make an appointment to enter the Utah Tax Commission in Salt Lake City he added.

Mail your payment to 210 North 1950 West. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Interest on any underpayment deficiency or delinquency of any tax or fee administered by the Commission shall be computed from the time the original return is due excluding any filing or.

Direct Deposit Follow the product or website instructions to have your. Do I need a form. Filing Paying Your Taxes This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

801-297-3600 Main Fax Number. You can also email your question to taxmasterutahgov. For information or queries you can search in the Ask a Tax Question section of the Utah tax commissions contact page.

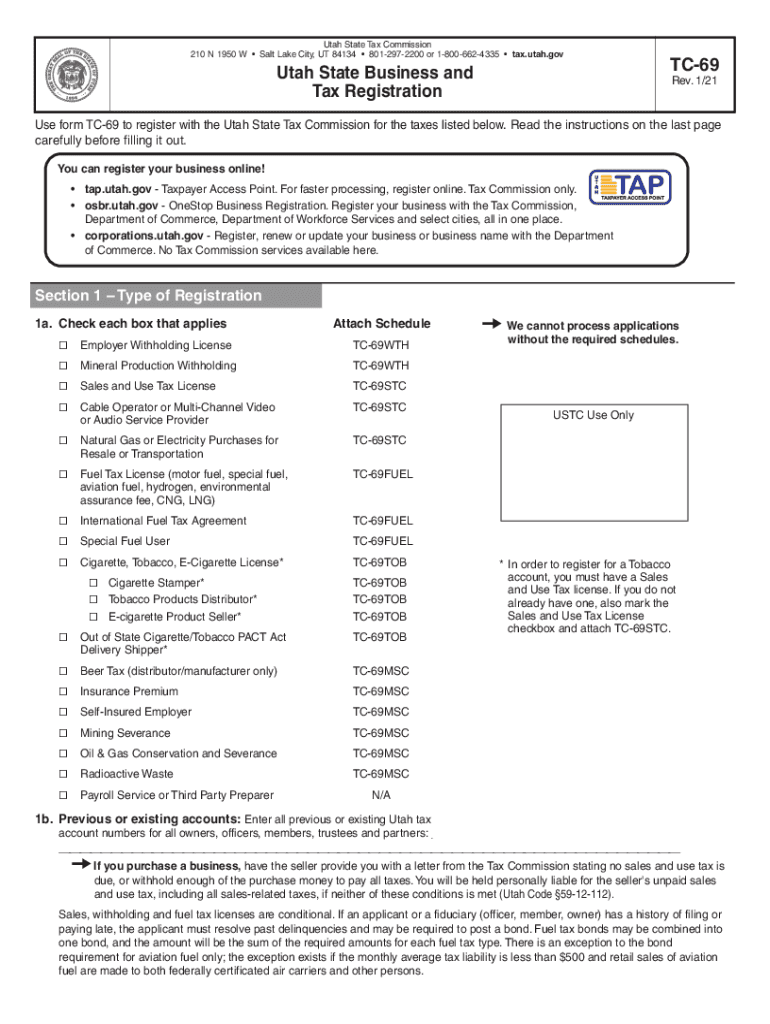

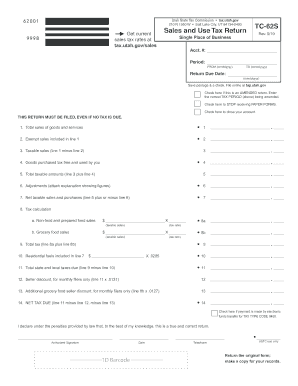

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Most taxes can be paid electronically. INSTRUCTIONS LINE-BY-LINE INFO FILING PAYING YOUR TAXES TOPICS CREDITS ADDITIONS ETC.

Income Tax Prepayment Utah State Tax Commission. Make sure you put your name and account number on your payment. Tax Payments If you owe tax you can still e-file early and pay your balance due by the due date.

REFUND METHODS INFORMATION FORMS PUBLICATIONS OFFICES. Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266. Yes a form is required for Purchase Card transactions.

If filing a paper return allow at least 90 days for your return to. Propertytaxutahgov Property Tax Payments.

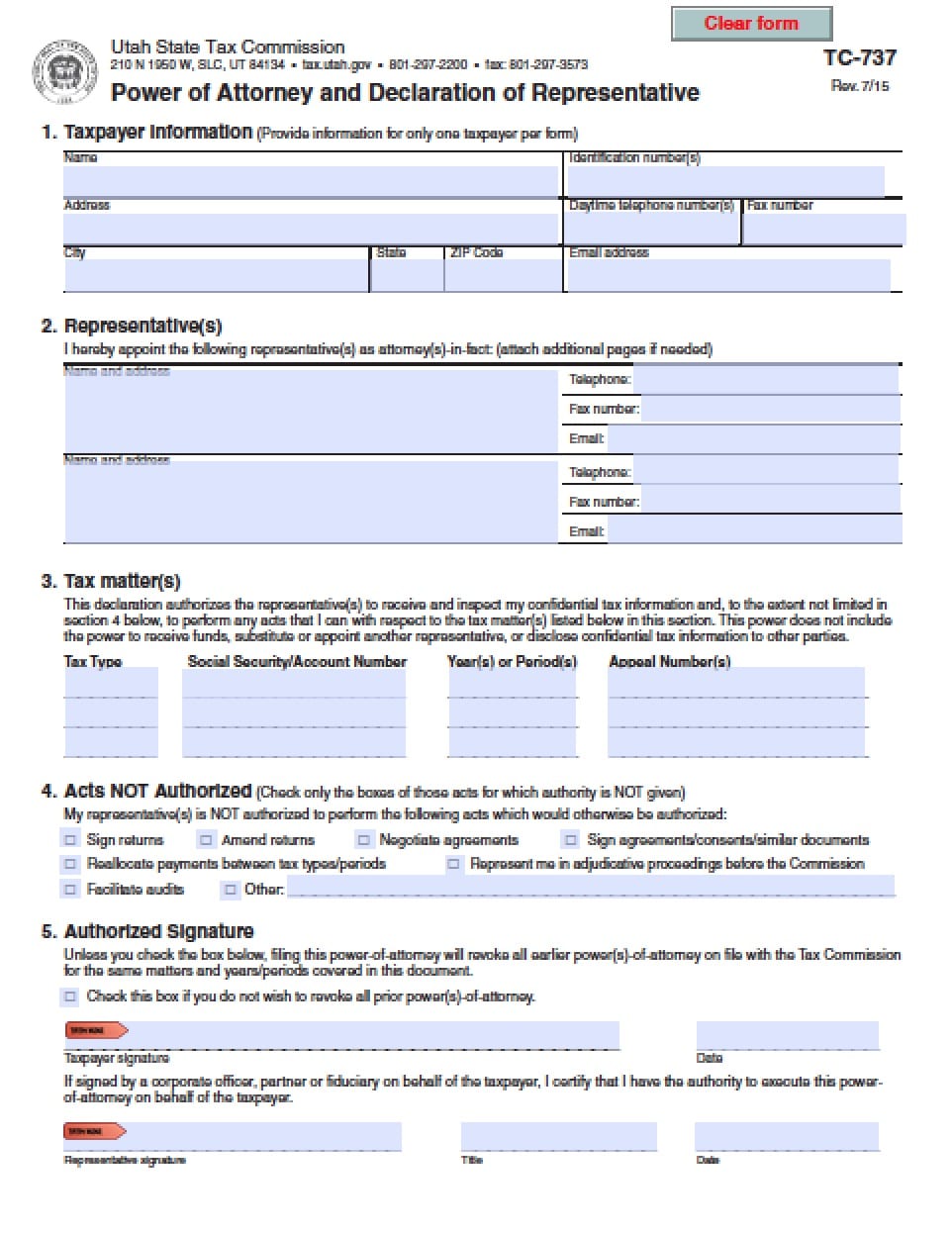

Utah Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

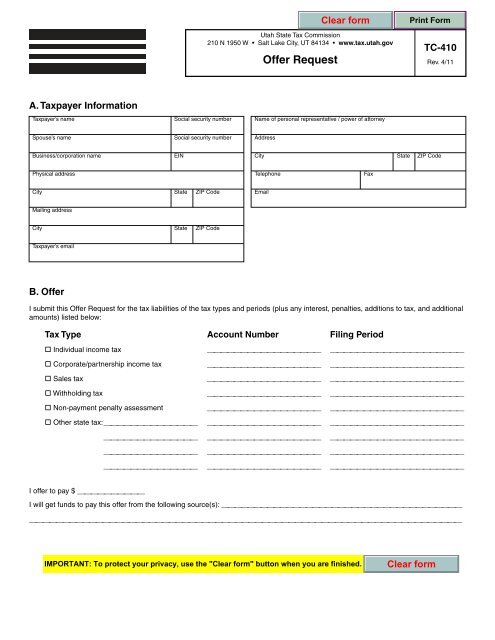

Tc 410 Utah Offer Request Utah State Tax Commission Utah Gov

Tc 20 Forms Utah State Tax Commission Fill Out Sign Online Dochub

Utah Tax Officials Mailed Out 13 000 Incorrect Billing Notices

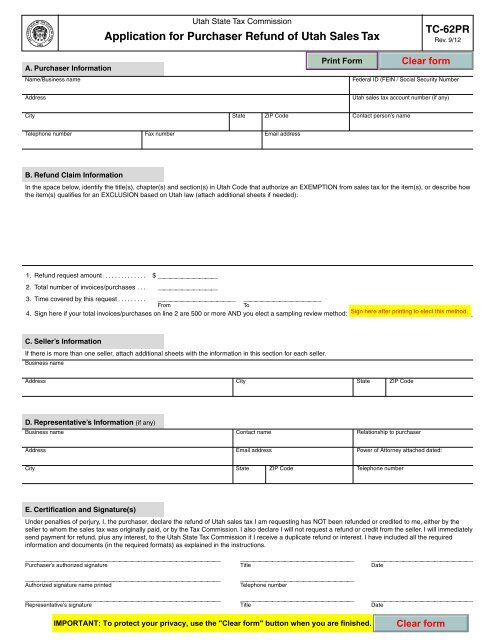

Utah Sales Use Tax Form Fill Out And Sign Printable Pdf Template Signnow

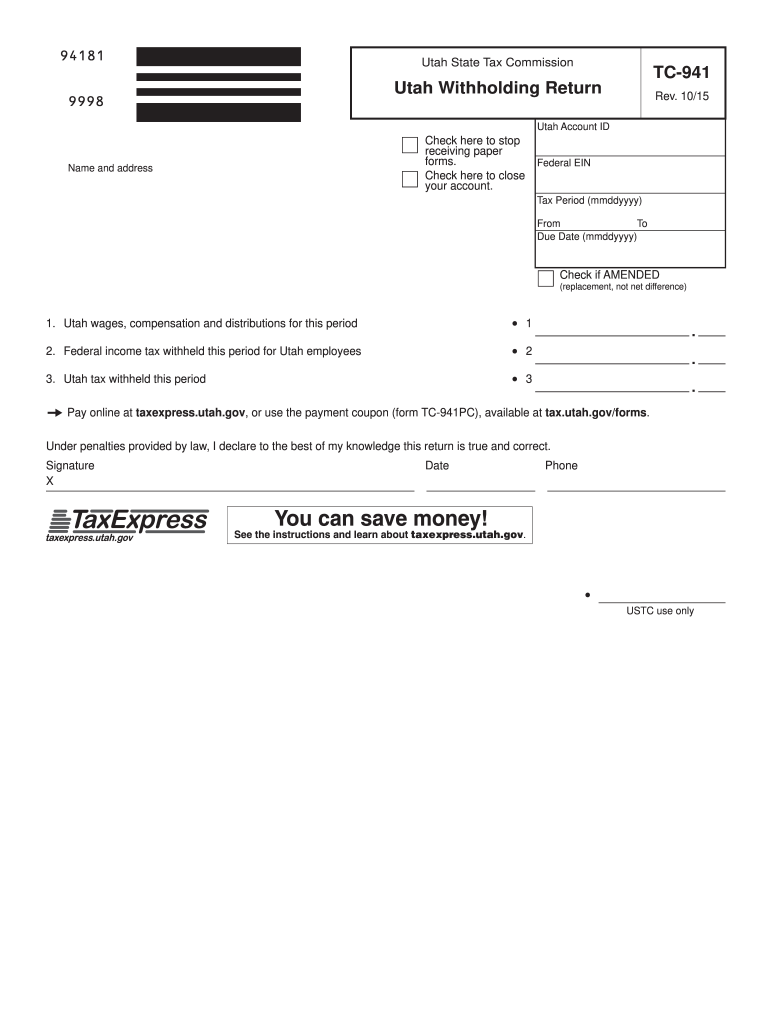

Tc 941e Fill Out Sign Online Dochub

Bill Of Sale Utah State Tax Commission State Tax Bills Bill Of Sale Template

Utah State Tax Commission Boyer Company

Voices For Utah Children Voices Statement Re Constitutional Amendment To End Education Earmark

Utah Tax Commission Reports 3 26b Increase In State Revenues Collected During 2021 Fiscal Year

Fillable Online Tax Utah Cover Letter For Tax Commission Form Fax Email Print Pdffiller

As Tax Season Begins Utah Tax Commission Warns Of Fraudulent Emails Seeking Taxpayer Info Kjzz

Tax Utah Gov Forms Current Tc Tc 559

Free Utah Tax Power Of Attorney Form Tc 737 Pdf Eforms

Utah State Tax Commission Notice Of Change Sample 1

18 Utah Sales Tax Token 1 Utah State Tax Commission Uts1 Our T1844 Ebay